Insurance Agent-Broker

Sell-Side M&A Advisory Services

Customized Solutions to Achieve

Your Financial & Strategic Transaction Objectives

141

Completed M&A transactions in last 5 years

75 yrs.

Combined experience for senior M&A advisors

Sell-Side M&A Advisory Services

Established in 2008, DCG Services National is a preferred leading mergers and acquisitions (M&A) advisory and consulting firm, exclusively providing sell-side M&A advisory and strategic transaction consulting services to independent insurance agencies and brokerage firms throughout the United States. Our team represents all types of insurance distribution businesses, including retail agencies, wholesale brokerages, MGAs and MGUs in the strategic marketing and sale of their insurance business. Assisting clients from coast to coast, our seasoned advisors have successfully completed hundreds of M&A sales transactions.

Schedule a Confidential Consultation

Our Core Values

Our core values — trust, integrity and excellence — form the cornerstone of our client relationships. These principles define our identity and shape our advisory services. As your trusted partner, we maintain open communication and process transparency while safeguarding your confidentiality throughout our entire sell-side engagement and beyond. In the pursuit of excellence, committed to your success, our team delivers customized, high-quality advisory services so that you can achieve your personal and financial goals.

Trust

Integrity

Excellence

Strategic Options, Customized Solutions

The sell-side M&A process is complex, fraught with potential pitfalls. You shouldn’t have to navigate this challenging journey alone. On average, our seasoned advisors complete approximately 30 M&A transactions annually, bringing decades of in-depth market knowledge and transaction expertise in insurance distribution to every sell-side engagement. We customize our solutions to achieve your financial and strategic transaction objectives. Whether you’re looking to sell and retire, exit the industry, or accelerate growth with a strategic partner, a leading private or private equity-backed national insurance brokerage, you can rely on our team of dedicated professionals to guide you through the entire process so that you realize your goals.

Expert Guidance, Tailored Approach

All insurance agencies and brokerage firms are unique. No two M&A transactions are the same. We begin by listening, developing a deep understanding of your objectives and goals, essential in customizing our process for every client. As your trusted partner, our team will manage and streamline the sales process, enabling you to stay focused on running your business. We align our interests with yours and tailor a comprehensive approach that meets your specific needs and goals, aligning with your strategic transaction objectives. Our depth of expertise stretches through all stages of the M&A process.

From initial planning to successful closing, we will guide you through each step of the transaction to ensure:

- Your value and terms are maximized for the purchase of your agency or brokerage.

- Your buyer shares your core values and is strategically aligned with your goals and vision.

- That you achieve your desired outcome, meeting and exceeding your expectations

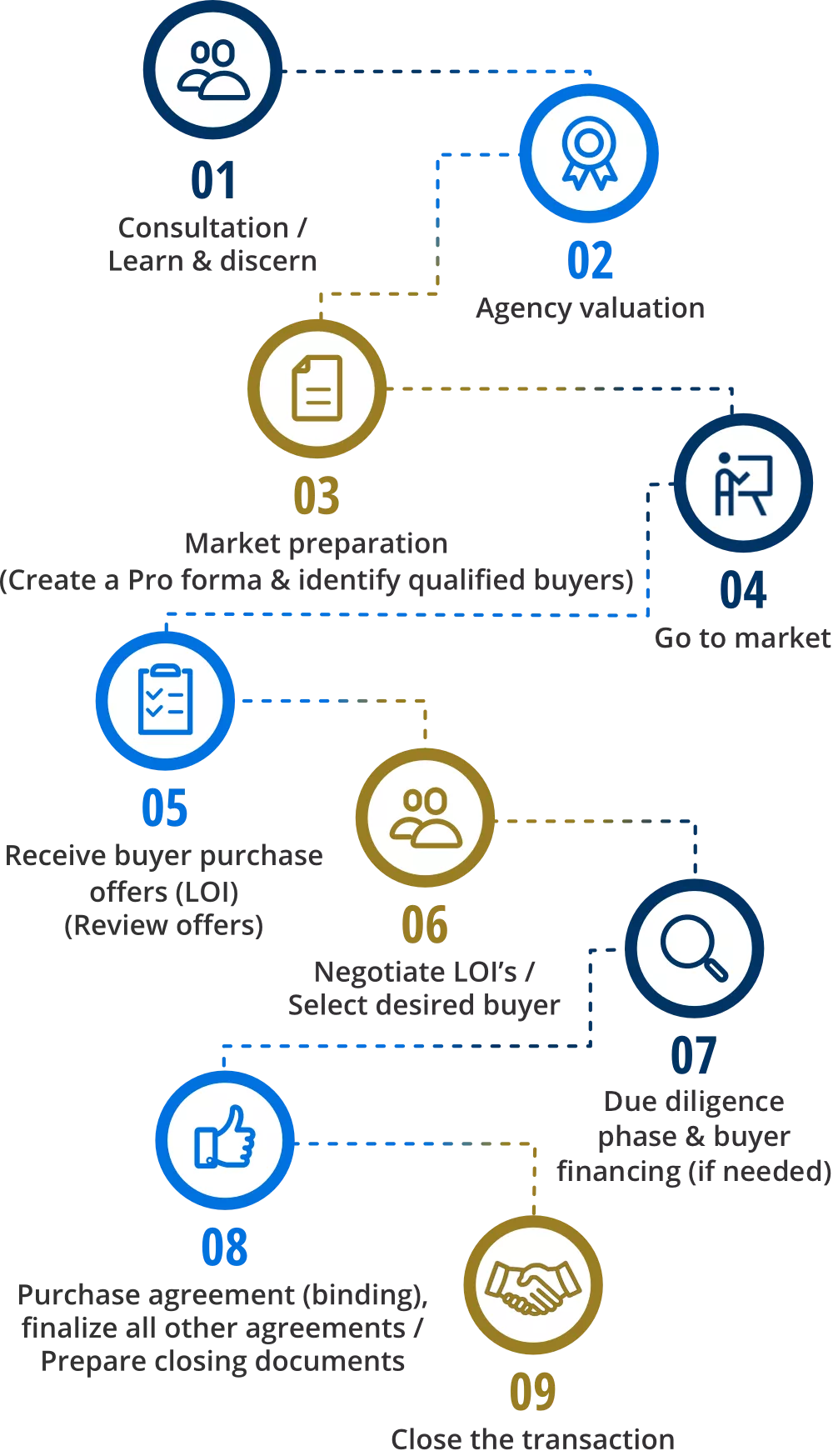

Proven Process

1. Consultation

We begin by listening to learn about you, your business, team, and culture. We will gain a thorough understanding of your objectives, short and long term goals, specific needs, and challenges.

We will advise you on current conditions in the marketplace, types of buyers and typical deal structures. We will review the sales process and answer all of your questions. Our advisors will give you an idea on the value of your insurance agency or brokerage.

After the consultation, we will request your financials to perform a valuation

and build a pro forma.

2. Valuation

After executing a mutual non-disclosure agreement (NDA) with you and

receiving back our document request, we will perform a well-supported valuation analysis of your agency/ brokerage, building version one of a Pro Forma financial model.

Our team understands the unique characteristics of insurance distribution businesses, both retail and wholesale. We perform a comprehensive analysis of your insurance agency or brokerage key financial metrics, operational drivers, and determine your EBITDA. We will provide you with our expert estimate on the value of your insurance agency or brokerage.

3. Marketing Preparation

We will work with you to create a confidential information memorandum (CIM). This important marketing document is an accurate, compelling detailed overview of your business, helping potential buyers to understand your business value and potential. We will create a marketing package which will include your CIM and pro forma.

Buyer Identification

Leveraging our knowledge of the M&A marketplace and vast professional network of relationships with qualified strategic buyers, top-tier investors, and contacts, we will identify potential buyers that are most ideal and strategically aligned.

4. Go to Market

A formal process that protects your confidentiality with

strict mutual NDA’s and processes.

Our team will engage with a strategically selected group of potential buyers.

All buyers that express interest will receive a compelling marketing package

containing your CIM and Pro forma to review and evaluate.

We will schedule initial meetings for you with the potential buyers of your choice. Our team will have you fully prepared. We will advise you on what questions to ask and how to respond.

All potential buyers will have a specified period of time to submit an offer,

Non-Binding Letter of Intent (LOI). Our process will create buyer demand and competition, strategically positioning your business, optimizing your appeal and our negotiating position to maximize the value of your transaction.

5. Receive & Review Offers

We will receive, review, and evaluate all offers (LOIs) with you. You will choose which attractive offers you would like us to negotiate on your behalf.

6. Negotiate & Select

Our senior level advisors will negotiate all client contracts. They are well prepared expert negotiators who are familiar with and understand all the negotiating strategies that buyers employ. Our advisors know what terms are customary in a contract and essential for our clients. They have negotiated hundreds of contracts. We represent our clients best interests, helping them to receive the highest EBITDA or revenue multiples, largest calculations of pro forma EBITDA, and the best possible terms.

Ultimately, you will choose your desired buyer.

7. Due Diligence (Buyer)

During this crucial step, the buyer will have a specified period of time to conduct a financial, operational, and legal review of your business to verify all the information provided to them. They have the ability to request additional documents. We will manage and coordinate all document requests with your buyer, their accountant, and attorney. Our team will have you fully prepared and advise you throughout the process.

8. Finalize / Execute

Finalize all agreements pertaining to the transaction. Execute and officially close the transaction.

Our Vast Professional Network of Relationships & Contacts

We have an expansive network of relationships with strategic buyers and top investors throughout the United States, including key, meaningful relationships with the Most prolific acquirers within the insurance distribution system for both private equity-backed and privately owned national insurance brokerages (Top 100 firms).

Leveraging our knowledge of the insurance M&A marketplace, deep industry expertise, and vast network of relationships, we are able to identify and obtain offers from the most qualified buyers for our clients. Our process is well-designed, creating unmatched demand and competition, strategically positioning your business to drive up and maximize the value while providing you with the ability to select a top acquirer that shares your values, culture, and goals.

Our clients typically obtain offers that are 30%+ higher vs. selling on their own or without representation from an insurance sell-side M&A advisor.

Optimizing Your Appeal

Whether you’re ready to sell now, next year, or several years from now, our seasoned advisors possess the knowledge, expertise, and resources to analyze and evaluate the intricacies of your insurance business. We understand the M&A marketplace and know the value drivers in an insurance agency and brokerage firm. Our team can advise you on preparing your insurance agency, providing strategic advice and market insights so that you are able to optimize your business’ appeal and maximize its value.

Sales Process Overview

* The Above Steps to Selling Your Independent Insurance Agency is a General Overview.