Sell-Side Advisory

Trusted Advisors, Deep Expertise

Selling an insurance agency-brokerage is a complex multi-phase transaction with many nuances, variables and moving parts both financial and legal. M&A transactions require specialized expertise at every stage. You shouldn’t have to navigate this challenging journey alone. On average, our experienced team of sell-side M&A advisors complete approximately 30 transactions annually, bringing deep knowledge of the M&A marketplace, transaction expertise in insurance distribution, and access to a broad professional network of relationships with qualified strategic buyers and leading institutional investors to every sell-side engagement. Whether you’re ready to sell and retire, exit the industry, or accelerate growth with a strategic partner, a private equity-backed national insurance brokerage, you can rely on our deep expertise, proven process, and dedicated team of advisors to strategically guide you through the sales process so you can maximize your value, achieve your goals, and secure your legacy.

Expert Guidance, Exceptional Results

All insurance agencies and brokerage firms are unique, and no two M&A transactions are ever the same. Our process begins by listening— taking the time to gain a deep understanding of your objectives, goals and long-term vision. As your trusted partner, our team will manage and streamline the sales process, maintaining clear communication and process transparency, enabling you to stay focused on running your business. We will tailor a comprehensive approach to meet your unique needs and goals while aligning your financial, strategic, and legacy objectives. Our depth of expertise stretches through all stages of the M&A process.

From initial planning to successful closing, we will strategically guide you through each step of the transaction to ensure:

- Your value is maximized and your terms are most favorable for the purchase of your insurance business

- You have the ability to select the buyer that’s most ideal, culturally and strategically aligned, not just the highest bidder.

- Risk is minimized and the transaction process remains controlled, efficient, and confidential

Proven Process

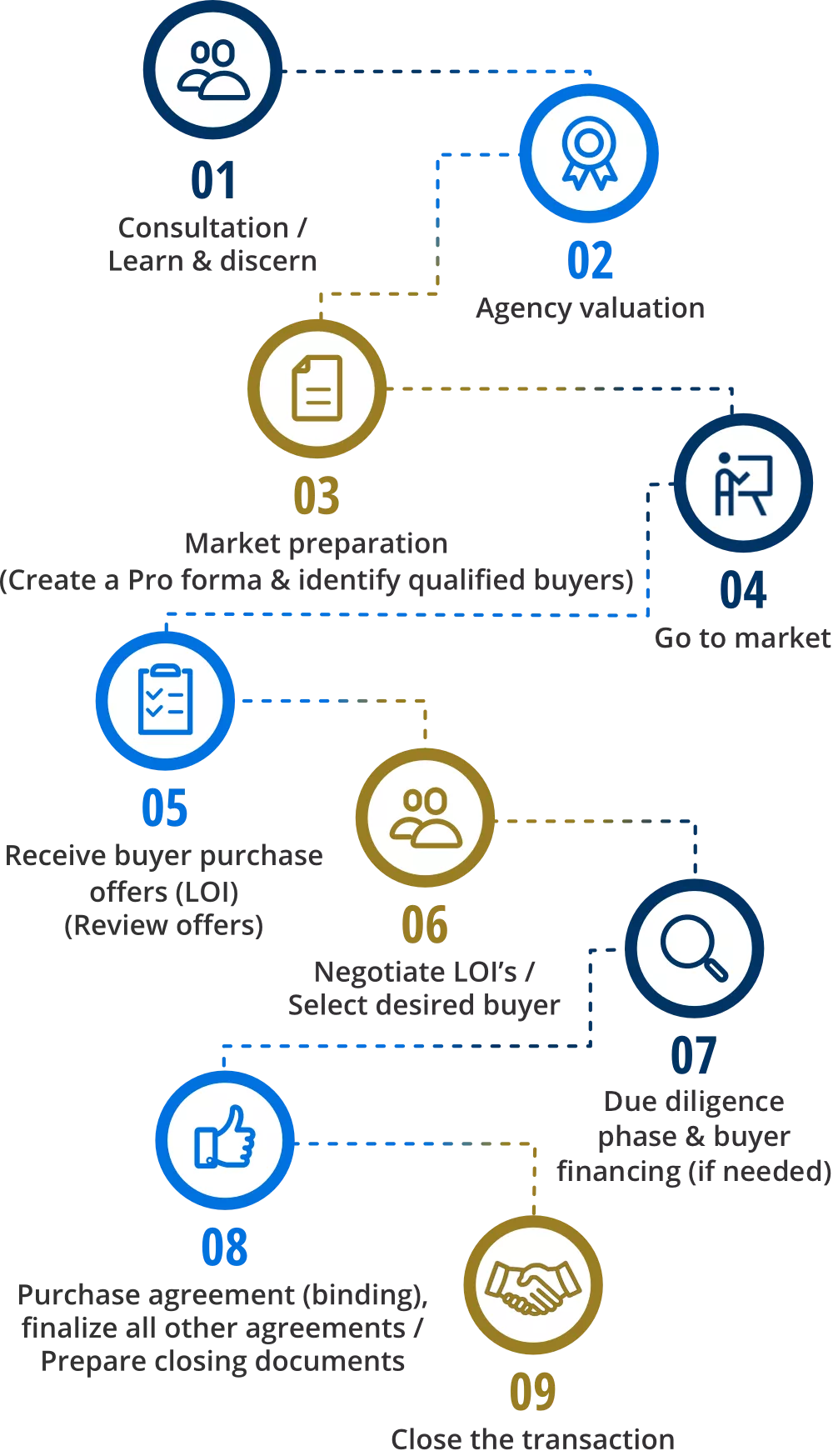

We begin by listening to learn about you, your business, team, and culture. Our goal is to gain a thorough understanding of your objectives, short and long-term goals, specific needs, and challenges.

We provide insight into current market conditions, buyer dynamics, and prevailing transaction structures. We will address your questions and share a preliminary perspective on the potential value of your insurance agency-brokerage.

Following the consultation we will request financial information to develop an adjusted pro forma, performing a formal valuation.

Upon execution of a mutual non-disclosure agreement (NDA) and receipt of requested documentation, we will perform a well-supported valuation analysis of your insurance agency-brokerage, building version one of an adjusted pro forma financial model. We provide you with our expert estimate on the market value of your insurance business.

During this stage we define our go-to-market approach.

Our team will collaborate with you to develop a comprehensive Confidential Information Memorandum (CIM). This foundational marketing document presents a detailed, accurate, and compelling overview of your insurance business, clearly articulating its financial performance, competitive advantages, and future growth potential.

We will prepare a complete marketing package that includes the CIM and pro forma financials to support informed buyer evaluation and competitive bidding.

Identify Potential Buyers

Drawing upon our experience, deep market insight, and broad professional network of qualified strategic buyers and institutional investors, we identify a targeted group of prospective acquirers. Each is carefully assessed for financial capability, strategic, and cultural alignment to ensure the strongest possible fit.

A formal process that protects your confidentiality with strict mutual NDA’s and processes.

Our team will approach a strategically selected group of potential buyers

to access interest and narrow the buyer pool to the most aligned parties.

After executing a mutual NDA, those interested buyers will receive your

CIM, Pro forma, and additional documents to review and evaluate.

Our team will schedule and conduct buyer meetings for you. We will advise

you on what questions you will be asked and have you fully prepared.

Our advisors will pre-negotiate any key transaction terms and we will assess and discuss buyer alignment with you. All potential buyers will have a specified period of time to submit best/final offers, a Non-Binding Letter of Intent (LOI), or we will manage a competitive auction.

We will receive, review and carefully evaluate all Non-Binding Letters of Intent (LOIs) with you. Together, we will assess the merits of each proposal, and you will determine which offers you would like us to negotiate on your behalf.

Our advisors will negotiate all selected LOI’s, including headline price and deal terms and structure.

We will advise and recommend a buyer, ultimately, the decision is yours to select the buyer that you prefer. We will then discuss and align on post-closing plans.

During this crucial step, your buyer will have a specified period of time to conduct a financial, operational, and legal review of your business to verify all the information provided to them. They have the ability to request additional documents. We will manage and coordinate all document requests with your buyer, their accountant, and attorney. Our team will have you fully prepared and advise you throughout the process.

Finalize Purchase Agreement and all other agreements pertaining to the transaction.

Execute and officially close the transaction.

Our Vast Professional Network of Relationships & Contacts

Our team has an expansive network of relationships with strategic buyers and institutional investors throughout the United States, including long standing, meaningful relationships with the most active and prolific acquirers within the insurance distribution system for leading national insurance brokerages.

By leveraging our knowledge of the insurance M&A marketplace, industry expertise, and vast professional network of buyers and top-tier investors, we are able to identify and secure interest from the most qualified buyers for each of our clients. Our confidential, structured process creates unmatched competitive demand—strategically positioning your business to maximize value. You will have the ability to choose from various types of the most qualified acquirers, giving you the flexibility to select the buyer and/or partner that is the best cultural and strategic fit—not just the highest bidder.

Our clients typically obtain offers that are 30% higher vs. selling on their own, without engaging a professional insurance sell-side M&A advisor.

Sales Process Overview

* The Above Steps to Selling Your Independent Insurance Agency is a General Overview.